Semi-Annual Financial Results Briefing

for Fiscal Year Ending March 2011

Oct. 29, 2010

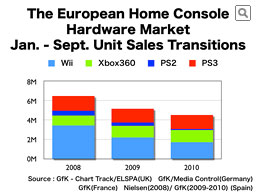

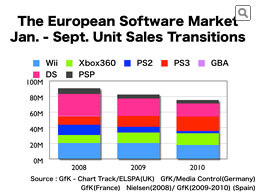

In this graph, Nintendo has gathered and tallied the home console video game hardware unit sales data for the January to September periods from 2008 to 2010, disclosed by independent research companies in the U.K., France, Germany and Spain. These four countries are assumed to represent 75% to 80% of the total European market, and I’d like to focus upon these figures to discuss pan-European trends.

Until my presentation of last year, we adopted the same scale with the graphs for both the U.S. and Europe. Please note that, for this time, since the gap between these two regions has widened in the last two years, we are applying different scales for the effective view of the each market’s graphs.

Unlike in the U.S., we do not see the noticeable increase in Xbox 360 sales in Europe. When we make a year-on-year comparison, Wii showed a decrease and both Xbox 360 and PS3 showed increases, but the fact that Wii has been the best-selling home console hardware with the largest share has not changed.

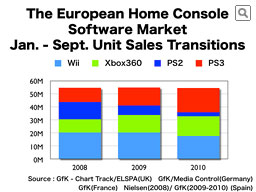

And, this is the transition of home console software unit sales in the January to September periods for the last three years.

As with the hardware, the software for Wii showed a year-on-year decrease. When we look at the home console software market in Europe as a whole, it appears to be at a standstill by keeping almost the same levels for the three years.

The size of the European home console software market is a little more than half of that of the U.S. In terms of its hardware installed base, slightly higher software sales should be expected, but when we see the situation from a different perspective, we can still see room for expansion with such efforts as increasing the social acceptance of video games there.

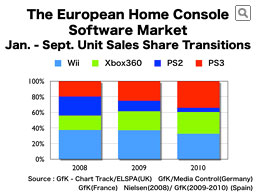

PS3 appears to have taken the PS2 market share. With that and other reasons, in the first nine months of this year, Wii’s software market share in Europe was a little less than that of PS3.

Here are the sales of handheld hardware in the European market. While Nintendo DS has constantly been leading the market, the spring sales this year could not catch up with the sales increase of a year ago, when Nintendo DSi was launched. When we focus upon the most recent weeks, the sales are just on par with last year’s sales.

This graph shows the unit sales transitions of handheld hardware in Europe.

Nintendo DS hardware showed year-on-year declines for two years in a row.

The ratio of the decrease varies by country. A notable decrease was found in the U.K. and in Spain, and the ratio of the decrease is relatively smaller in France and Germany.

We are now seeing the transitions of the handheld software unit sales in Europe. The European handheld software market had once rapidly grown to a level which could be compared with that in the U.S. However, while the home console software market has been able to maintain a similar market size over the past two years, the handheld software failed to do the same in Europe.

Some say that such devices as MagiCom, which promote illegal copies of software, are mainly responsible for these changes happening in the European handheld software sales. And recently, court rulings against these devices, by recognizing their illegality, have been issued in succession in Europe. The fact that, with the proliferation of such devices, Europe has become the market where illegal copies have spread most widely among all the advanced nations in the world must have affected the change in the size of the entire European market. However, given the fact that some Nintendo DS software titles are selling very well in Europe even today, it is too premature to conclude that the illegal copies are the sole reason.

We assume that several reasons are intertwined, such as, the days when any Nintendo DS software could sell are over and consumers have become more selective and, as a result, the gap in the unit sales between hit titles and non-hit titles has expanded and, almost at the same time, illegal copies have spread across Europe. Also, after the "nintendogs" and "Brain Training" software titles showed explosive sales there, we have been unable to offer another software title that European consumers really feel like purchasing.

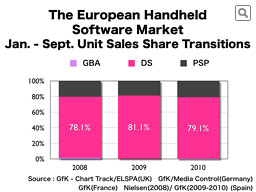

When we look at market share, Nintendo DS has kept its high market share. Yet, we cannot be satisfied with high market share alone amid the rapid change in the market.

Already in next year, we will launch Nintendo 3DS, but for the existing Nintendo DS family of devices, while we’ll intensify the legal and technical countermeasures against the likes of MagiCom, we’d like to change the situation by creating hit titles by leveraging, upon the already existing huge installed base of the hardware.

"Pokémon HeartGold" and "Pokémon SoulSilver" that we launched in March this year have become long-seller hit titles, and their sales have the momentum to outpace the sales transition of "Pokémon Diamond" and "Pokémon Pearl". "Dragon Quest IX" is steadily increasing its sales although the way it is selling in Europe is different from its Japanese sales. "Art Academy" has shown unexpectedly high launch sales, so much so that stock shortages were found in several regions. We can still expect a sales increase for this title. The initial sales volume of the third iteration of the Professor Layton series looks similar to that of the previous title in the series, which has sold over 1.7 million units in Europe. We are looking forward to how this game sells from now.

This chart combines the software sales for both home consoles and handheld devices. As I said, the handheld software showed a decline while the home console software kept level with the previous year. As a result, the entire software market in Europe saw a decline.

As the software unit sales for both Wii and Nintendo DS showed decline, Nintendo’s software sales share in Europe too has declined so far this year, and is now 2% below the company’s software share in the U.S.

Finally, let me discuss the situation in Japan.